Often bars and restaurants will charge both a sales tax (I.E. State Sales Tax) as well as a separate Alcohol/Liquor tax. MicroSale can separate out these two taxes for reporting purposes for you, automatically. The following explains in detail how to configure your MicroSale system to charge a separate Alcohol/Liquor tax.

Special Tax Setup

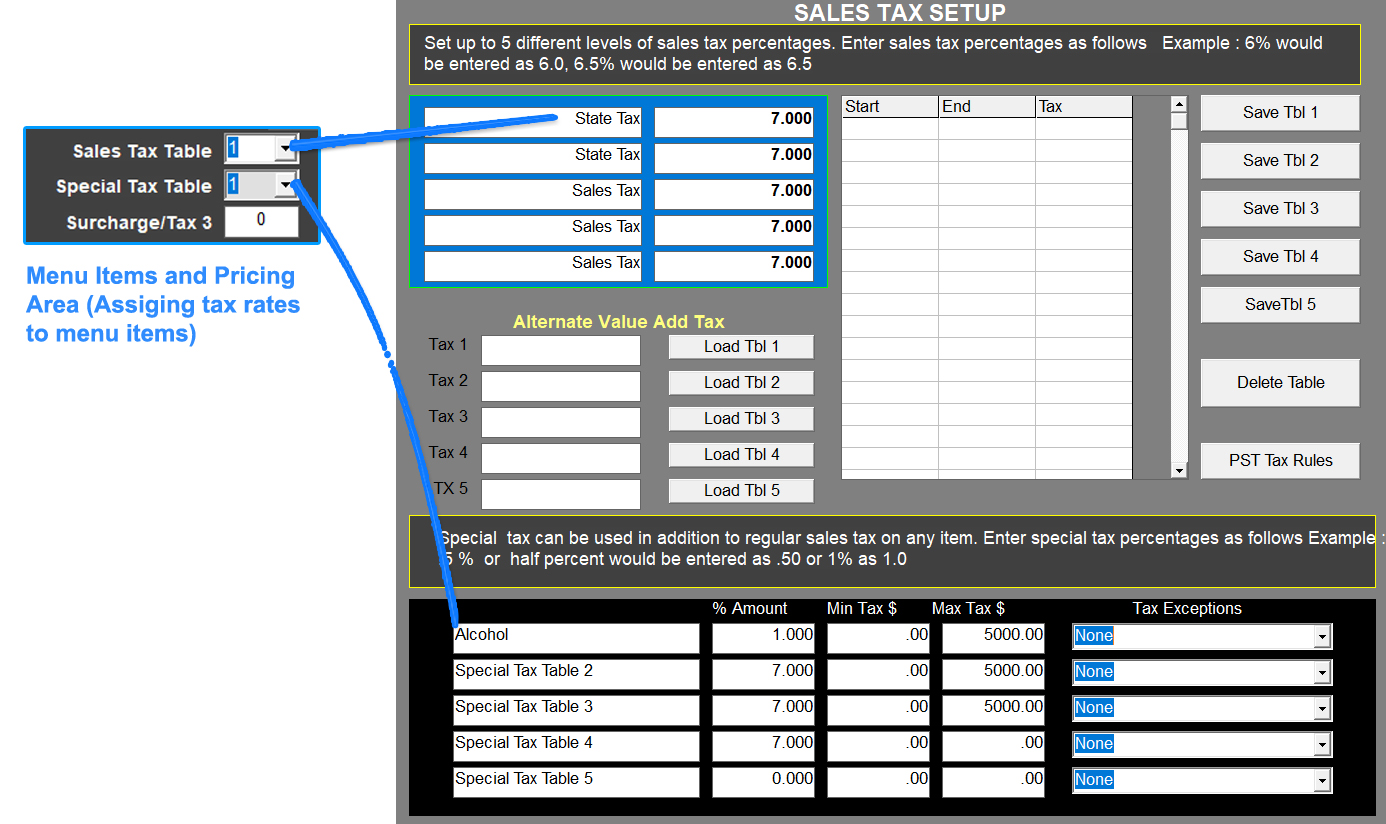

- Go to the Managers Menu > Register Setup > Sales Tax Menu

- The bottom section (shown in black) is the area in which you can configure a separate Alcohol/Liquor tax

- The following information will need to be entered:

Notes:

- You can change the name of the Special Tax to anything within a specific character limit

- The % Amount is the tax rate for the Alcohol/Liquor Tax

- Define the smallest amount on which tax must be collected. Set to 0.01 for no minimum.

- Define the largest amount on which tax must be collected. Set to 9999.99 for no maximum.

- The tax exemption area is used when specific order types should be exempt from taxes (such as To Go, Delivery, etc. if you do not need this, keep it at "None" or "Off".

Assigning the menu item to a special tax:

Go to the Managers Menu > Menu Maintenance > Menu Items and Pricing

Each menu item that will have an alcohol/liquor tax applied towards it will need:

- Enable the checkbox for “Taxable”

- Set the Sales Tax Table = 0 (Unless you charge BOTH a Sales Tax and an Alcohol/Liquor Tax on this item, then enter “1”)

- Set the Special Sales Tax Table = 1

- Select the “Save” button

Example, the menu item “Bud Light” is assigned to the Special Tax Table “1” and the Sales Tax Table “0”, meaning it only is taxed with the "alcohol" tax and not the standard state sales tax.