If your establishment uses tax inclusive menu items (such as alcoholic items include tax in the price; example, Bud Light is $3.00 including tax in the total), some cities calculate tax inclusive with a value added tax. This feature is typically not required by your department of revenue. However, if it is, you will need to obtain the VAT rate from them.

An Alternate Value Add Tax is used to ensure you are collecting enough tax on tax inclusive items. In some cases, you are required to collect a slightly larger percentage on tax inclusive items.

Setup

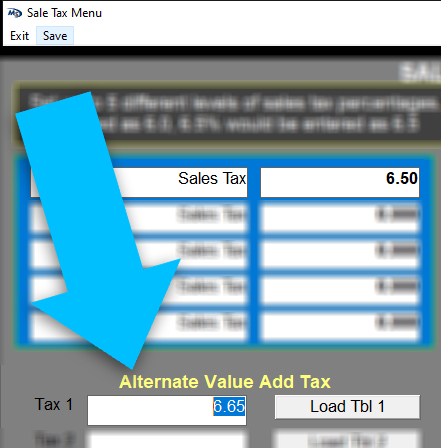

- Once you have the VAT rate from your department of revenue, go into MicroSale > Managers Menu > Register Options > Sales Tax Menu

- Type in the rate and select Save (hint: this rate will always be larger than your standard sales tax rate)